The Real Estate Journey

The road to homeownership may seem overwhelming but when you take it step by step, you’ll soon reach your destination – your dream home!

Your First Home

- Set up a designated down payment savings account.

- Pay down credit card and other debt.

- Look into first-time homebuyer programs.

Need More Space

- Make bigger (or additional) mortgage payments.

- Refinance and shorten your mortgage loan term.

- Reduce expenses to save money.

Time to downsize

(or invest in property)

- Talk to your financial professional about tapping into your home’s equity.

- Think about the type of home and community you want to live in.

- Start organizing now.

Journey Essentials:

- Good credit and low consumer debt.

- A professional agent in your corner.

- A positive attitude – don’t give up!

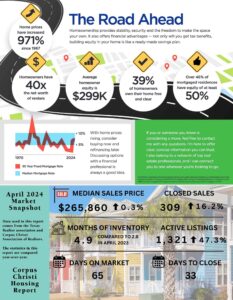

The Road Ahead

Homeownership provides stability, security and the freedom to make the space your own. It also offers financial advantages – not only will you get tax benefits, building equity in your home is like a ready-made savings plan.

- Home prices have increased 971% since 1967

- Homeowners have 40x the net worth of renters

- Average homeowner equity is $299K

- 39% of homeowners own their home free and clear

- Over 46% of mortgaged residences have equity of at least 50%

With home prices rising, consider buying now and refinancing later. Discussing with a financial professional is always a good idea.

If you or someone you know is considering a move, feel free to contact me with any questions. I’m here to offer clear, concise informati0n you can trust. I also belong to a network of top real estate professionals, and I can connect you to one wherever you’re looking to go.

For a printable copy of this newsletter, click here.

Sources: 1. bankrate.com/home-equity/homeowner-equity-data-and-statistics 2. In2013dollars.com/Housing/price-inflation 3. axlos.com/2023/12/12/mortgage-free-homes 4. Fred.stlouisfed.org 5. Keeping Current Matters 6. Icemortgagetechnology.com/resources/data-reports/february-2024-mortgage-monitor