The market is hot! For financially secure potential buyers and sellers, low interest rates and tight inventory have made it the perfect time to act. The data below demonstrates the power of low interest rates and explores the market conditions that are making right now a great time to sell. Let me know how I can help you!

SAMPLE MORTGAGE SCENARIO*

(*Payments exclude property tax & insurance.)

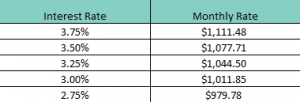

Conventional 30-Year Fixed Mortgage

- Home Purchase Amount: $300,000

- 20% Down Payment: $60,000

- Loan Amount: $240,000

Total Savings with Lowest Rate: (30-Year Fixed Mortgage): $47,411.49

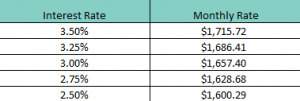

Conventional 15-Year Fixed Mortgage

- Home Purchase Amount: $300,000

- 20% Down Payment: $60,000

- Loan Amount: $240,000

Total Savings with Lowest Rate: (15-Year Fixed Mortgage): $20,776.32

Putting less than 20% down?

A down payment under 20% often requires an additional payment for Private Mortgage Insurance (PMI). This is a fee (0.55% to 2.25% of the total loan) lenders tack onto conventional loans to protect themselves from default, and it can be divided up and added to your monthly payment.

Ready to Act?

Wondering what your mortgage options look like? I know an excellent lender who can help you navigate the current mortgage rates. Give me a call!!

**Sources: Buffini & Company